Dough Finance, a trading platform co-founded by Chase Herro of World Liberty Financial (WLFI), is under scrutiny following a recent hack that siphoned millions of dollars from client accounts. A report by Reuters indicates that clients are still awaiting compensation after the breach.

Hackers Exploit Vulnerability in Dough Finance

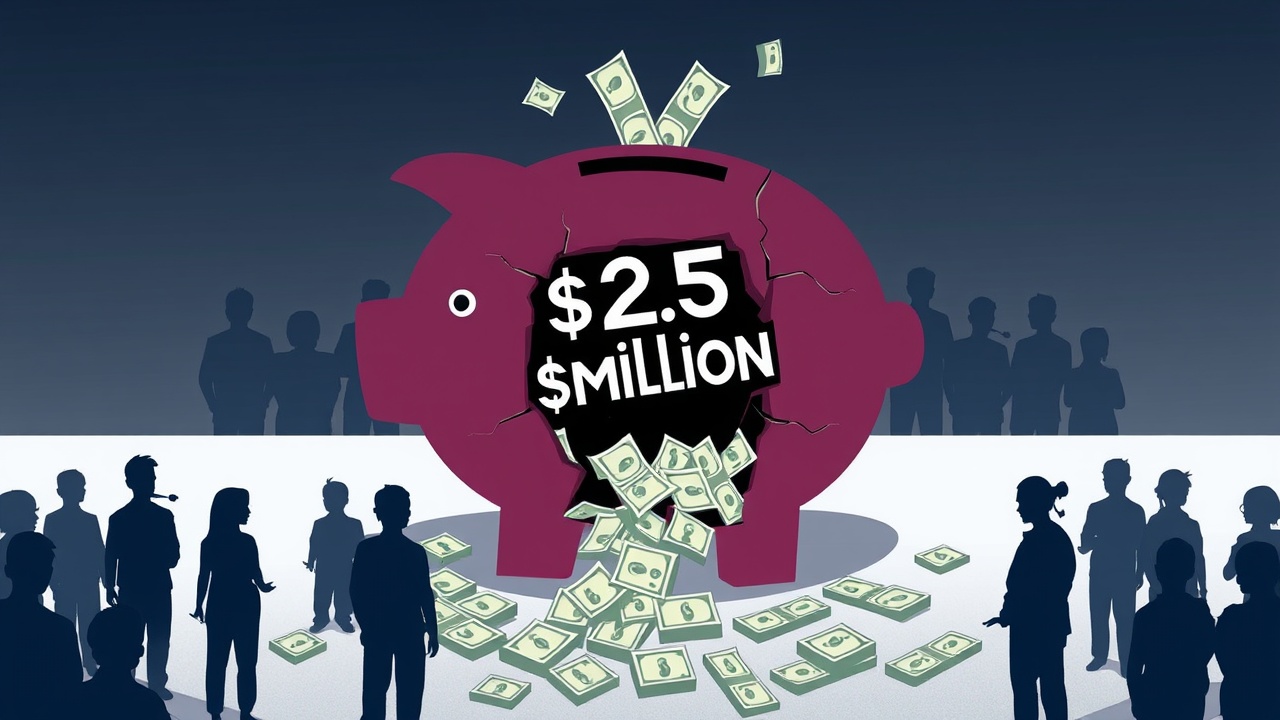

On July 12, hackers exploited a vulnerability in Dough Finance’s code, draining $2.5 million from investor Jonathan Lopez‘s account. Lopez had initially invested $1 million in cryptocurrency through the platform in May 2024, paying a 5% fee for the service. Herro reportedly provided Lopez with a personal tutorial on how to navigate the platform.

In a strategy known as “looping,” Lopez increased his holdings by purchasing the same digital asset multiple times, using the newly acquired cryptocurrency as collateral for additional purchases. Unfortunately, this strategy collapsed when the hacking incident occurred just two months later.

Lawsuit Against Dough Finance

Following the hack, Dough Finance’s long-standing business partner, Zachary Folkman, asserted that the organization is committed to ensuring all affected clients are “made whole.” In a statement released in July, the company reiterated its dedication to high security standards and transparency, acknowledging their shortcomings and expressing regret:

“We will continue to work diligently to protect our users and their assets, learning from this incident to enhance our security posture.”

However, reports indicate that both Folkman and Herro ceased communication on their Telegram channel by August 18. Shortly thereafter, the Trump-affiliated World Liberty Financial announced a new digital asset venture in which Herro and Folkman would serve as partners.

In August 2024, Dough Finance revealed plans to issue proprietary tokens equivalent to the missing funds, which could be exchanged for Ethereum (ETH). However, this proposal was met with dissatisfaction from several clients.

Lopez, unsatisfied with the resolution, is moving forward with a lawsuit against Herro, which is set to go to trial in April 2026.